Posted At: Aug 05, 2025 - 10,735 Views

10 minutes to read

The world of grocery delivery apps has evolved at breakneck speed. In 2025, these platforms are no longer just about convenience; they are redefining retail and shaping consumer behaviour across the globe. From ultra-fast delivery promises to AI-driven product suggestions, grocery shopping has moved from supermarket aisles to smart devices.

Businesses now see huge potential in launching or scaling their own SaaS grocery delivery app solutions, leveraging innovations like cloud-based grocery delivery software and white-label grocery delivery app providers . The opportunity lies in tapping into this high-growth, high-demand industry with smart tech, smart logistics, and smart branding.

The Past of Grocery Delivery Apps

From Phone Orders to Website Checkouts: The Evolution of Grocery Delivery Apps

The early 2000s saw the first wave of digital grocery evolution. Phone-based ordering gave way to basic web interfaces where customers could place orders online. This marked the first major step in shifting grocery shopping habits from physical stores to digital platforms.

Customers were hesitant at first, as shopping for perishable items online felt risky. But early adopters quickly discovered the convenience of browsing, ordering, and scheduling delivery, something traditional shopping couldn’t match.

The Rise of First-Mover Platforms (e.g., BigBasket, Instacart)

BigBasket in India and Instacart in the U.S. were among the earliest players to popularise full-service grocery delivery apps. BigBasket introduced scheduled delivery and cash-on-delivery features in India, while Instacart built a marketplace connecting users with personal shoppers at stores like Kroger and Costco.

These platforms overcame major barriers like real-time inventory sync, user trust, and payment processing by investing in backend infrastructure and intuitive front-end UX.

Early Challenges: Logistics, Inventory & Trust

Building early on-demand grocery delivery app development solutions wasn’t easy. Delivery delays, stock-outs, and customer complaints plagued many startups. Without smart logistics, real-time stock management, or trained delivery staff, many apps failed to scale.

Security and hygiene concerns also limited early traction, especially for perishable goods. The breakthrough came when platforms started integrating custom grocery delivery software development that connected inventory management, delivery logistics, and customer service into a seamless flow.

The Present Landscape of Grocery Delivery (2025)

Quick Commerce Takes Over: 10-Minute Delivery Race

The rise of quick commerce (Q-commerce) has redefined consumer expectations. Indian startups like Blinkit, Zepto, and Swiggy Instamart promise grocery delivery in under 15 minutes, powered by hyperlocal warehouses (dark stores), predictive ordering, and optimised last-mile delivery.

This shift has forced even traditional retailers to adopt bespoke grocery delivery app solutions to compete with the speed and convenience these platforms offer.

The Power of Partnerships: Retail Chains + Tech Platforms

Collaboration is the new competition. Traditional retail giants like Walmart (via Walmart+), Target (via Shipt), and Carrefour are integrating with or acquiring tech partners to digitise and scale their delivery services.

This hybrid model combines the supply chain and store footprint of legacy retailers with the speed and scalability of modern cloud-based grocery delivery software.

User Experience Innovations: Real-Time Tracking & Personalisation

2025 grocery delivery apps are engineered for personalisation. AI algorithms track user behaviour, offering smart search results, dietary recommendations, and seasonal suggestions.

Real-time order tracking, interactive delivery maps, and in-app support are now standard. Apps like Instacart and Uber Eats use AI-driven SaaS grocery delivery app solutions to deliver a superior experience that builds retention and loyalty.

Subscription Economy

Membership models have seen a boom. Walmart+, Shipt, and Amazon Fresh offer subscription-based perks free delivery, exclusive deals, and early access to products, which increase customer LTV.

For new businesses, incorporating Essential grocery delivery app features like subscription billing into your ready-made white-label grocery app is now critical for long-term success.

Global Expansion Strategies of Leading Apps

Apps like Uber Eats, Glovo, and DoorDash have entered new markets through M&A, localisation, and regulatory alignment. Uber Eats operates in 70+ countries and continues expanding via its shared driver infrastructure.

To compete globally, companies must build scalable, multilingual apps with localised payment and compliance layers, a key reason many turn to custom grocery delivery software development.

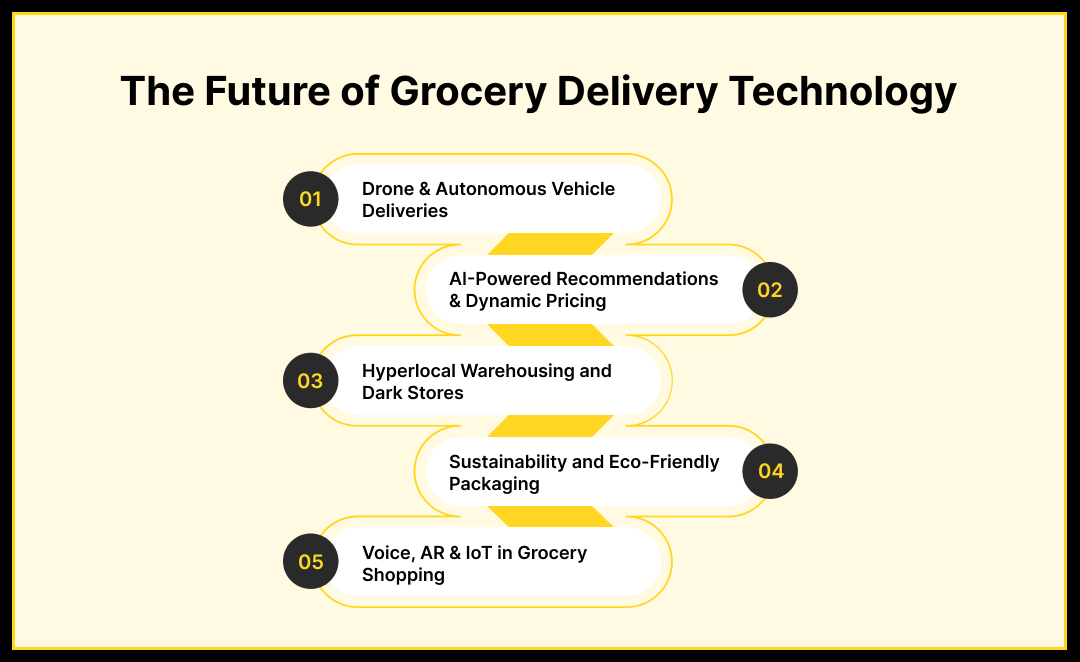

The Future of Grocery Delivery Technology

Drone & Autonomous Vehicle Deliveries

Future-ready grocery apps are preparing for drone drops and autonomous delivery bots. These technologies will reduce human labour costs and make 24/7 fulfilment possible.

In countries like the U.S., pilot programs by Kroger and Amazon are already testing autonomous carts and drones for short-range deliveries. According to Statista’s global grocery delivery market forecast , the grocery delivery segment is projected to grow steadily and reach over $800 billion by 2030.

AI-Powered Recommendations & Dynamic Pricing

AI is powering smart pricing engines that change based on supply, demand, user behaviour, and market trends. Users receive real-time pricing suggestions, offers, and bundle deals personalised to their shopping history.

Platforms like Amazon Fresh lead the way, using AI-powered grocery delivery apps to optimise conversion rates and cart values.

Hyperlocal Warehousing and Dark Stores

Dark stores are micro-fulfilment centres located near high-demand zones. By predicting demand and stocking fast-moving products, apps like Zepto and Blinkit can promise sub-15-minute deliveries.

Hyperlocal warehousing will soon become the industry standard—an essential capability for any on-demand grocery delivery platform looking to offer quick commerce.

Sustainability and Eco-Friendly Packaging

Green logistics are now a business imperative. From recyclable packaging to electric vehicle fleets, sustainability is not just about compliance; it’s a core value.

Users increasingly choose apps that promote zero-waste packaging, carbon-neutral deliveries, and sustainable sourcing, making it essential to integrate these values into your product roadmap.

Voice, AR & IoT in Grocery Shopping

Voice commerce (e.g., “Alexa, reorder milk”) and augmented reality (AR) tools for viewing product packaging and expiration dates are gaining traction.

Smart refrigerators integrated with IoT can now auto-order groceries when stock runs low, syncing with grocery delivery apps in real time. These technologies not only enhance UX but also drive daily app engagement.

Top 15 Grocery Delivery Apps in the World (2025)

North America Market

1. Instacart

Stock Symbol: NASDAQ: CART

Market Position: Leading SaaS grocery delivery app solution in the U.S.

Instacart revolutionised grocery delivery by connecting customers with personal shoppers across 5,500+ cities in North America. The platform partners with major retailers, including Costco, Safeway, and Kroger, offering both scheduled and same-day delivery options through their sophisticated cloud-based grocery delivery software.

Technology Architecture:

- Backend: Python-based microservices architecture

- Mobile: React Native applications optimised for on-demand grocery delivery platform functionality

- Database: PostgreSQL for comprehensive data management

- Infrastructure: AWS cloud platform supporting scalable operations

- AI/ML: Advanced route optimisation and inventory prediction algorithms

Key Features:

- Instacart+ premium membership with free deliveries

- Real-time shopper communication system

- Custom grocery delivery software development capabilities for enterprise clients

- 2023 IPO success demonstrates market validation for SaaS grocery delivery app solutions

2. Amazon Fresh

Stock Symbol: NASDAQ: AMZN

Global Presence: United States, United Kingdom, Germany, India

Amazon Fresh operates as an integrated grocery delivery service within the Amazon ecosystem, exclusively available to Prime members. The platform delivers fresh produce, dairy, and household essentials with advanced logistics capabilities powered by cloud-based grocery delivery software.

Technology Architecture:

- Infrastructure: AWS cloud services supporting global operations

- AI Integration: Alexa voice ordering for seamless on-demand grocery delivery platform access

- Analytics: Predictive analytics and machine learning optimisation

- Inventory: Real-time management systems with automated restocking

Key Features:

- Prime member exclusivity with integrated benefits

- Same-day and next-day delivery options

- Voice ordering through Alexa smart devices

- White-label grocery delivery app provider model for select partners

3. Shipt

Parent Company: Target Corporation (NYSE: TGT)

Coverage: 5,000+ cities nationwide

Shipt focuses on personalised grocery shopping experiences with dedicated shoppers. As a Target subsidiary, it maintains partnerships with major retailers including CVS and Costco, demonstrating successful custom grocery delivery software development within existing retail ecosystems.

Technology Architecture:

- Backend: Node.js supporting high-performance operations

- Mobile: React Native for cross-platform on-demand grocery delivery app development

- Communication: Real-time chat functionality between shoppers and customers

- Matching: Advanced algorithms for optimal shopper-customer pairing

Key Features:

- $99/year membership model with unlimited deliveries

- GPS tracking and in-app communication systems

- Dynamic pricing models based on demand

- Personal shopper relationships fostering customer loyalty

4. Walmart+

Stock Symbol: NYSE: WMT

Service Model: Integrated retail ecosystem

Walmart+ demonstrates cloud-based grocery delivery software integration within a major retail chain. The $98 annual membership includes grocery delivery, fuel discounts, and scan-and-go shopping features, showcasing how traditional retailers can build an on-demand grocery delivery platform.

Technology Architecture:

- Logistics: Proprietary network integration with existing infrastructure

- IoT: Advanced inventory management sensors

- Architecture: Mobile-first design optimised for customer experience

- Integration: Seamless local store system connectivity

Key Features:

- Existing store infrastructure utilisation for cost efficiency

- Multi-benefit membership program is increasing customer retention

- Rapid fulfilment capabilities through a distributed network

- Traditional retail digital transformation success story

5. DoorDash

Stock Symbol: NYSE: DASH

Service Expansion: Restaurant to grocery delivery evolution

DoorDash expanded its platform to include comprehensive grocery delivery through partnerships with Albertsons, Meijer, and Safeway. DashPass membership streamlines multi-category deliveries, demonstrating effective white-label grocery delivery app provider capabilities.

Technology Architecture:

- Routing: Sophisticated optimisation algorithms for multi-stop deliveries

- Tracking: Real-time GPS systems with predictive arrival times

- AI/ML: Advanced demand prediction models

- Infrastructure: Scalable cloud-based grocery delivery software architecture

Key Features:

- Multi-category delivery platform leveraging existing infrastructure

- Existing driver network utilisation for rapid market expansion

- Ready-made white-label grocery app solutions for retail partners

- Cross-platform synergies maximising operational efficiency

6. Uber Eats

Stock Symbol: NYSE: UBER

Global Operations: United States, Australia, Latin America

Uber Eats leverages Uber's driver network for grocery delivery across multiple international markets. The platform unifies grocery and restaurant orders within a single application, showcasing an efficient on-demand grocery delivery platform design.

Technology Architecture:

- Core Platform: Microservices architecture supporting global scale

- Tracking: Real-time GPS integration with advanced route optimisation

- Pricing: Dynamic algorithms responding to supply and demand

- Optimisation: Machine learning delivery routing for maximum efficiency

Key Features:

- Unified app experience reduces customer acquisition costs

- Strategic dark store partnerships for faster fulfilment

- Uber One membership benefits across service categories

- Global platform scalability supporting international expansion

7. Kroger

Stock Symbol: NYSE: KR

Innovation Focus: Automated fulfilment technology

Kroger combines traditional grocery retail with innovative automated fulfilment centres powered by Ocado technology. The platform maintains both proprietary services and third-party integrations, representing successful custom grocery delivery software development in established retail.

Technology Architecture:

- Automation: Ocado warehouse systems with robotic fulfilment

- AI: Advanced inventory management and personalised recommendations

- Integration: Digital coupon systems and loyalty program connectivity

- Partnerships: Multi-platform delivery support through various providers

Key Features:

- Automated warehouse operations reduce labour costs

- Smart shopping list algorithms improve customer experience

- The Delivery Savings Pass program encourages repeat purchases

- Traditional retail digital adaptation maintaining competitive advantage

Asia Market

8. Blinkit

Parent Company: Zomato Ltd (NSE & BSE)

Service Promise: 10-minute delivery guarantee

Blinkit operates India's fastest grocery delivery service through strategically placed dark stores (micro-warehouses) in major metropolitan areas, including Delhi, Mumbai, and Bangalore. Their bespoke grocery delivery app solution focuses on ultra-fast fulfilment.

Technology Architecture:

- Inventory: Advanced management systems with predictive restocking

- AI: Sophisticated demand forecasting algorithms

- Tracking: Real-time delivery monitoring with customer updates

- Logistics: Hyperlocal optimisation supporting rapid delivery promises

Key Features:

- Ultra-fast 10-minute deliveries setting industry standards

- Strategic dark store network minimising delivery distances

- Zomato backing, providing financial stability and integration opportunities

- Quick-commerce segment leadership in the competitive Indian market

9. Swiggy Instamart

Company Status: Privately Held

Service Model: 15-30 minute delivery window

Instamart represents Swiggy's expansion into grocery delivery, combining existing delivery infrastructure with strategically positioned dark stores for rapid fulfilment. This demonstrates effective on-demand grocery delivery platform expansion from restaurant delivery.

Technology Architecture:

- Inventory: Real-time tracking systems with automated alerts

- Routing: Advanced optimisation algorithms for multi-category deliveries

- Analytics: Predictive demand planning reduces stockouts

- Integration: Seamless Swiggy network connectivity maximising efficiency

Key Features:

- Swiggy ecosystem integration leveraging the existing customer base

- Strategic dark store utilisation for rapid fulfilment

- Speed-focused delivery model competing with specialised providers

- Restaurant-to-grocery expansion demonstrating platform versatility

10. Zepto

Headquarters: Mumbai

Company Status: Privately Held

Founders: Stanford dropout entrepreneurs

Zepto disrupts India's grocery market with 10-minute delivery promises, serving tier-1 cities through technology-driven efficiency and optimised dark store networks. Their SaaS grocery delivery app solution targets tech-savvy urban consumers.

Technology Architecture:

- Logistics: Sophisticated algorithms optimising micro-fulfilment

- Tracking: Real-time rider monitoring with predictive analytics

- Inventory: Predictive management systems reduce waste

- Optimisation: Hyperlocal warehousing strategy supporting speed commitments

Key Features:

- Gen-Z targeted user interface with modern design principles

- Live delivery updates maintain customer engagement

- Ultra-fast delivery focuses on differentiating from traditional players

- Innovative logistics approach challenging established competitors

11. BigBasket

Parent Company: Tata Digital (Privately Held)

Market Position: India's most trusted grocery platform

BigBasket operates with over a decade of experience, offering scheduled deliveries, express 90-minute slots, and subscription services. Tata Group backing provides additional credibility and resources for custom grocery delivery software development initiatives.

Technology Architecture:

- Inventory: Comprehensive management systems across multiple categories

- AI: Advanced recommendation engines personalising customer experience

- Fulfilment: Multi-channel capabilities supporting various delivery models

- Services: Integrated vending and instant delivery solutions

Key Features:

- BB Daily subscription service ensures recurring revenue

- BB Instant smart vending is expanding accessibility

- BB Now express delivery is competing with quick-commerce players

- Mature platform offering diverse bespoke grocery delivery app solutions

Europe Market

Spain

12. Glovo

Parent Company : Delivery Hero SE (Frankfurt Stock Exchange)

Global Reach: 25+ countries across Europe, Africa, Latin America

Glovo operates as a comprehensive multi-category delivery platform, delivering groceries, meals, medicine, and personal items through strategic partnerships with Carrefour and Lidl. Their white-label grocery delivery app provider model supports international expansion.

Technology Architecture:

- Platform: Multi-category architecture supporting diverse product types

- Tracking: Real-time courier monitoring with customer notifications

- AI: Advanced logistics optimisation, reducing delivery times

- Integration: Dark store connectivity enabling rapid fulfilment

Key Features:

- Distinctive yellow branding creates strong market recognition

- Multi-category delivery service maximising customer lifetime value

- International market expansion through localised cloud-based grocery delivery software

- Dark store integration supporting quick-commerce capabilities

13. Mercadona

Company Status: Privately Held

Market Position: Spain's largest grocery chain

Mercadona's online service represents custom grocery delivery software development tailored for Spain's dominant grocery retailer. Operating in major cities through dedicated fulfilment warehouses, they maintain brand consistency while building an on-demand grocery delivery platform.

Technology Architecture:

- Warehousing: Proprietary management systems optimised for fresh products

- Optimisation: Advanced time-slot algorithms maximise delivery efficiency

- Handling: Specialised fresh produce technology maintains quality

- Integration: Private-label inventory systems supporting brand strategy

Key Features:

- Brand consistency maintenance across digital and physical channels

- Dedicated warehouse fulfilment ensuring product quality

- Major city coverage with expansion plans

- Private-label integration supporting competitive pricing

France

14. Carrefour

Stock Symbol: Euronext Paris: CA

Global Operations: 30+ countries, including Brazil, Spain

Carrefour operates a global grocery delivery platform across multiple international markets, offering store delivery, click-and-collect, and app-based shopping with AI-powered recommendations. Their SaaS grocery delivery app solution adapts to local market requirements.

Technology Architecture:

- AI: Advanced recommendation engines improving conversion rates

- Integration: Loyalty program systems encouraging repeat purchases

- Sustainability: Environmental tracking supporting corporate responsibility

- Fleet: Electric delivery vehicles reducing environmental impact

Key Features:

- Multiple fulfilment methods offering customer flexibility

- AI-powered recommendations are increasing average order value

- Sustainability focus appeals to environmentally conscious consumers

- International retail chain model leveraging existing infrastructure

Australia Market

15. Woolworths

Stock Symbol: ASX: WOW

Market Position: Australia's grocery delivery leader

Woolworths leads Australia's market with comprehensive features including voice search, personalised specials, and multiple fulfilment options (home delivery, click-and-collect, drive-up service). Their on-demand grocery delivery app development focuses on customer convenience and sustainability.

Technology Architecture:

- Voice: Recognition technology enabling hands-free shopping

- Personalisation: AI algorithms tailoring customer experiences

- Fleet: Electric delivery vehicles supporting environmental goals

- Sustainability: Environmental tracking systems monitor carbon footprint

Key Features:

- Voice search capabilities provide accessibility advantages

- Environmental responsibility focuses on sustainable practices

- Multiple fulfilment options accommodating diverse customer preferences

- Sustainability-conscious development appealing to eco-aware consumers

Regional Insights & Market Highlights

- North America is dominated by platform giants like Instacart, Amazon Fresh, and Walmart+.

- Europe is seeing a blend of traditional retailers (Carrefour, Mercadona) adopt omnichannel strategies.

- India is the epicentre of quick commerce innovation, led by Blinkit, Zepto, and Swiggy Instamart.

- Australia stands out with Woolworths’ seamless digital transformation.

- Latin America & Spain benefit from Glovo’s multi-vertical expansion strategy.

Comparison Table: Reach, Features, and Expansion

App | Regions Covered | Model Type | Key Features |

Instacart | North America | Marketplace | Partnered with major US retailers |

Amazon Fresh | US, UK, Germany, more | Prime-based | Exclusive for Prime members |

Shipt | US (5,000+ cities) | Subscription + Retail | Same-day with personal shoppers |

Walmart+ | US | Membership | Combines groceries with retail |

DoorDash | US, Canada, Asia | Commission-based | Fast scaling via existing delivery fleet |

Uber Eats | 70+ countries | Cross-category | Food + grocery + promotions |

Blinkit | India (metros) | Q-commerce | 10-minute delivery, dark stores |

Swiggy Instamart | India | Inventory-led | Massive fulfilment network |

Zepto | India | Quick commerce | 6 AM–2 AM delivery windows |

BigBasket | India, UAE | Inventory + Subscript. | B2B and B2C models |

Glovo | Europe, LatAm | Multi-category | Groceries, food, packages |

Mercadona | Spain | Omnichannel | Retail-first, logistics control |

Carrefour | Europe, Asia | Inventory-led | Physical & digital synergy |

Woolworths | Australia | Hybrid | Click & collect + delivery |

Kroger | US | Hybrid | Owned + partner integrations |

Conclusion: Key Takeaways for Businesses & Users

In 2025, grocery delivery is not just a convenience; it’s a core expectation for consumers worldwide. From the hyper-growth of quick commerce in India to the robust omnichannel models in Europe and North America, the industry is undergoing rapid transformation. Businesses are leveraging AI, dark stores, and real-time logistics to stay competitive, while users demand speed, personalisation, and reliability. The success of apps like Instacart, Blinkit, and Amazon Fresh proves that tech-driven grocery delivery models are not only scalable but essential for future retail growth. For brands and entrepreneurs looking to enter this space, investing in a customizable, white-label grocery delivery app can unlock long-term value and user loyalty.

Frequently Asked Questions (FAQs)

1. Which are the fastest grocery delivery apps in 2025?

Zepto, Blinkit, and Swiggy Instamart offer 10–15-minute deliveries across urban India.

2. How do grocery delivery apps make money?

Revenue comes from delivery fees, commissions, subscriptions, in-app advertising, and partnerships with retailers.

3. What is the best grocery delivery app in the US?

Instacart leads with 73% market share and integrations with major chains like Costco and Kroger.

4. Can I launch a grocery delivery app without building from scratch?

Yes! You can use a ready-made white-label grocery app or go for a custom grocery delivery platform from providers like Nectarbits.

5. What technology is essential in grocery delivery apps today?

AI, dark stores, real-time tracking, voice assistants, and sustainability integrations are must-have features.