Posted At: Feb 11, 2026 - 17 Views

10 minutes to read

For a long time, fuel delivery was seen as a startup-driven idea, apps promising convenience, quick refills, and doorstep service. I’ve watched many of those early models focus heavily on the app experience while underestimating what really matters in fuel operations: compliance, logistics, and scale.

That thinking has changed.

Today, on-demand fuel delivery is becoming a serious growth opportunity for oil companies serving fleets, enterprises, and bulk customers. Large businesses don’t care about flashy apps; they care about uptime, safety, predictable supply, and visibility across operations. Fuel delivery is no longer a consumer convenience play; it’s an enterprise service model.

From my experience working with enterprise platforms, oil companies don't need to build complex technology from scratch to enter this space. Developing dispatch systems, compliance workflows, and billing engines in-house is slow, costly, and risky. Instead, many are choosing a white-label fuel delivery app that's already built for regulated, high-volume operations.

This approach lets oil companies launch faster, stay compliant, and keep full control of their brand, while avoiding the burden of in-house tech development. In the sections ahead, we’ll explore how this model works and why it’s becoming the preferred path for enterprise fuel delivery.

Why Oil Companies Are Entering On-Demand Fuel Delivery

Most blogs explain on-demand fuel delivery as a response to convenience. That’s only part of the story, and honestly, it’s the least interesting part for oil companies.

What’s really driving adoption is B2B and fleet fueling demand.

Over the last decade, I’ve seen fuel buyers shift from retail pumps to contracted supply models. Logistics companies, construction firms, generators, mining sites, and large campuses don’t want vehicles queuing at stations or manual fuel tracking. They want fuel delivered on schedule, invoiced accurately, and reported centrally. This is where on-demand fuel delivery becomes a strategic service, not a consumer feature.

Another key reason is the difference between commercial contracts and retail walk-ins. Retail fuel sales are volume-driven but margin-sensitive and unpredictable. Enterprise contracts, on the other hand, offer recurring demand, negotiated pricing, and long-term relationships. When oil companies deliver directly to fleets and bulk customers, they gain far more control over pricing, supply planning, and customer retention.

Technology plays a critical role here. Managing enterprise customers at scale requires more than a mobile app; it requires scheduling logic, compliance workflows, fleet visibility, automated billing, and reporting. This is why oil companies are increasingly investing in enterprise fuel delivery software that supports high-volume operations, multiple customer types, and strict regulatory requirements.

Perhaps the biggest shift I’ve observed is ownership of the customer relationship. On-demand delivery allows oil companies to move closer to their customers, collect better consumption data, and tailor services around actual usage patterns. That insight is hard to achieve through traditional retail-only models, and it’s becoming a major competitive advantage.

The Real Challenge: Building Fuel Delivery Technology In-House

Building fuel delivery technology in-house often looks straightforward on a roadmap. In practice, it’s one of the biggest obstacles oil companies face when entering on-demand delivery. Over the years, I’ve seen strong operations delayed, not by fuel supply, but by software complexity.

1. High development and hidden costs

What starts as an “app build” quickly expands into dispatch engines, compliance workflows, billing systems, fleet tracking, and reporting dashboards. Each layer requires specialized engineering, testing, and infrastructure. In many enterprise projects I’ve worked on, costs multiply long before the platform is production-ready.

2. Long and risky time-to-market

Fuel delivery platforms must be operationally stable before launch. Regulatory approvals, safety validation, and real-world pilot testing can take months or longer. While internal teams are still building, competitors using ready platforms are already servicing enterprise clients and refining operations.

3. Compliance complexity at scale

Fuel delivery is tightly regulated. Licensing, audit trails, safety documentation, and regional rules must be enforced consistently. Building systems that adapt to regulatory changes without disrupting operations is far more difficult than most teams anticipate.

4. Ongoing maintenance and security exposure

Launching the platform is only the beginning. Continuous monitoring, security patching, uptime guarantees, and disaster recovery are non-negotiable. In regulated industries, a system failure isn’t just technical; it carries legal and reputational consequences.

These challenges are why many oil companies realize that building technology from scratch pulls focus away from what they do best. Recognizing this early is often the moment organizations begin looking for more practical, scalable alternatives.

What Is a White-Label Fuel Delivery Platform?

“White-label” is a term that’s often mentioned in fuel delivery discussions but rarely explained in a way that actually helps oil companies make decisions. In simple terms, a white-label fuel delivery platform is ready-made fuel delivery software that an oil company can launch under its own brand, without building the technology from scratch.

From projects I’ve worked on, this means the platform operates as if it were developed internally, while the heavy technical work is already done. The oil company focuses on operations and growth, not software engineering.

A true white-label platform typically includes:

- Full branding control – The platform carries the oil company’s name, logo, and workflows, not the vendor’s.

- Customer and data ownership – All customer relationships, fuel usage data, and transaction records remain with the oil company.

- Enterprise-grade functionality – Dispatch management, fleet tracking, compliance workflows, invoicing, and reporting are built in.

- Configurable business rules – Pricing models, service areas, delivery schedules, and user roles can be tailored without code changes.

It’s also important to understand how white-label platforms compare to other approaches:

- SaaS tools are quick to start, but often limit customization and data control.

- Custom-built platforms offer flexibility but come with high costs, long timelines, and ongoing maintenance risk.

- White-label platforms strike a balance, fast deployment with enterprise control and scalability.

For oil companies entering on-demand fuel delivery, this model removes technical friction while preserving brand authority, compliance, and operational ownership.

How Oil Companies Launch Fuel Delivery Using White-Label Platforms

Launching fuel delivery at an enterprise level isn't about switching on an app. In every oil company rollout I've been involved in, success comes from treating the platform as an operational system first, and a digital product second. White-label platforms make it easier to launch fuel delivery platform solutions by shortening the learning curve and reducing risk.

Here’s how oil companies typically approach the launch.

1. Platform selection and compliance readiness

The first step is choosing a white-label platform that’s already built for regulated fuel operations. This means the platform supports safety documentation, audit trails, delivery logging, and regional compliance requirements. In practice, teams involve operations, legal, and compliance early, because retrofitting compliance later is expensive and disruptive.

2. Custom branding and operational configuration

Once selected, the platform is branded to match the oil company’s identity. But branding goes beyond logos. Workflows are configured to reflect how the company operates, delivery windows, approval flows, pricing rules, service zones, and role-based access. In one rollout I worked on, adjusting approval hierarchies alone reduced delivery delays by over 20%.

3. Fleet and depot onboarding

Next comes onboarding physical assets. Delivery vehicles, depots, drivers, and dispatch teams are added to the system. This step is critical because fuel delivery is as much about ground operations as software. Successful teams run hands-on training with dispatchers and drivers to ensure real-world adoption, not just system availability.

4. ERP, CRM, and payment integration

Enterprise fuel delivery can’t operate in isolation. White-label platforms are integrated with existing ERP systems for invoicing, CRM platforms for customer management, and secure payment gateways. This ensures fuel orders flow cleanly from booking to billing without manual reconciliation, a common pain point in early-stage deployments.

5. Pilot launch followed by phased rollout

Instead of launching everywhere at once, oil companies usually start with a controlled pilot, one city, one fleet segment, or a few enterprise customers. This allows teams to fine-tune operations, validate compliance, and gather real usage data. Once stable, the rollout expands in phases, minimizing risk while scaling confidently.

This structured approach is why white-label platforms work. They allow oil companies to launch faster, stay compliant, and scale fuel delivery as a core enterprise service, without the uncertainty of building everything from scratch.

Must-Have Features in Enterprise Fuel Delivery Software

At enterprise scale, fuel delivery is less about placing orders and more about running a tightly controlled operation. From the projects I’ve worked on, the platforms that succeed are the ones designed to handle complexity without slowing teams down. That’s where the right enterprise fuel delivery software makes a measurable difference.

- Fleet and route optimization

Efficient delivery planning has a direct impact on cost, safety, and reliability. Advanced fleet and route optimization tools account for vehicle capacity, delivery priorities, traffic conditions, and service windows. In one large rollout, optimizing routes helped reduce unnecessary travel and improve on-time deliveries across multiple depots.

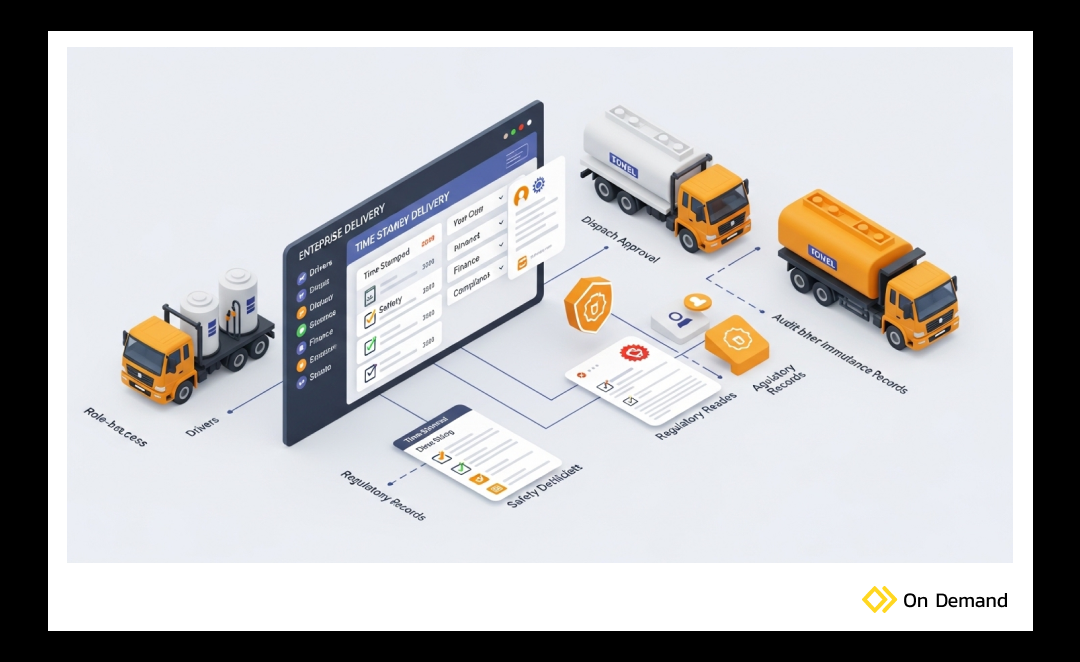

- Role-based access and operational clarity

Fuel delivery involves dispatchers, drivers, operations managers, finance teams, and compliance officers. Each role needs a clear, controlled view of the system. Role-based access ensures dispatchers manage schedules, drivers focus on deliveries, and administrators oversee performance and compliance—without overlap or confusion.

- Automated invoicing and contract management

Enterprise customers expect billing accuracy and consistency. Automated invoicing applies contract pricing, taxes, and delivery confirmations without manual input. This reduces billing disputes and shortens payment cycles, which is especially important when managing high-volume commercial accounts.

- Real-time analytics and performance reporting

Operational visibility is one of the most valuable outcomes of modern fuel delivery platforms. Real-time dashboards show delivery status, fuel consumption, fleet utilization, and customer trends as they happen. Over time, this data supports better supply planning and more informed commercial decisions.

- Compliance-ready delivery tracking

Every delivery needs to be traceable, from dispatch to completion. Time stamps, quantities, vehicle data, and safety checks are logged automatically, making audits and regulatory reviews far easier to manage.

When these features work together, fuel delivery software becomes more than a tool; it becomes the operational backbone of enterprise fuel delivery.

Read More: Discover how enterprise fuel delivery features work in real operations in the Filld App fleet fueling case study.

Compliance, Safety & Regulatory Readiness at Scale

When fuel delivery operations scale beyond a few locations, compliance and safety stop being operational tasks and become business-critical systems. In my experience working with large fuel operators, the biggest risks rarely come from technology failure; they come from weak regulatory alignment and inconsistent safety execution across fleets and depots.

Regulatory compliance built for India’s fuel ecosystem

In India, fuel delivery platforms must align with PESO regulations governing fuel storage, tanker certification, driver training, and delivery procedures. Enterprise systems need the flexibility to enforce PESO-approved workflows while accommodating state-level operational variations. I’ve seen rollouts stall simply because platforms couldn’t adapt to local compliance requirements without manual workarounds.

Operational traceability and audit readiness

At scale, every fuel movement must be digitally traceable. From dispatch approval to delivery confirmation and invoicing, enterprise platforms must maintain a complete audit trail. This traceability is essential not only for regulatory inspections but also for resolving commercial disputes and internal reviews.

Industry data supports this shift, 82% of carriers report that digital systems improve safety standards, and 83% of fleet managers say data analytics is critical for operational efficiency, reinforcing why traceability is no longer optional in regulated logistics operations. (Source: wifitalents)

Key audit capabilities include:

- Time-stamped delivery and dispatch logs

- Digital proof of delivery with quantity validation

- Immutable records for compliance and financial audits

Safety workflows embedded into daily operations

Enterprise fuel delivery requires proactive safety enforcement, not reactive reporting. Platforms should mandate pre-dispatch safety checks, driver acknowledgments, and escalation protocols for incidents such as spills, vehicle faults, or site hazards. In one deployment I worked on, digitized safety workflows reduced incident reporting delays from days to minutes.

Data security and controlled system access

Fuel delivery platforms manage sensitive operational, customer, and financial data. Role-based access ensures dispatchers, drivers, finance teams, and compliance officers only interact with data relevant to their responsibilities. Combined with encrypted storage and secure authentication, this protects both regulatory integrity and commercial interests.

When compliance and safety are designed into the platform, not added later, fuel delivery operations scale faster, operate with confidence, and earn long-term trust from regulators and enterprise customers alike.

White-Label vs Building In-House vs Custom Development

When oil companies explore fuel delivery platforms, the first instinct is often, “Should we build this ourselves?” After a decade of advising enterprises on this decision, I’ve learned that the real comparison isn’t about technology capability, it’s about risk, speed, and long-term return.

Building in-house gives maximum control, but it also demands heavy upfront investment, a specialized product team, and long development cycles. For regulated industries like fuel, even a small compliance miss can delay launch by months. I’ve seen internal builds stretch beyond 18 months before a single commercial delivery went live.

Custom development through a custom delivery app development company reduces some internal burden, but the risk still stays with the oil company. You're funding R&D, validating workflows, and absorbing regulatory learning costs. Custom builds also tend to lock companies into long-term maintenance dependencies.

White-label fuel delivery platforms, on the other hand, are designed specifically to minimize uncertainty. These platforms are already production-tested, compliance-ready, and optimized for scale. Oil companies focus on branding, operations, and customers, not reinventing infrastructure.

Here’s how the options compare from a decision-maker’s perspective:

| Criteria | White-Label Platform | In-House Build | Custom Development |

|---|---|---|---|

| Upfront Cost | Predictable, subscription-based | Very high (team, infra, R&D) | High project cost |

| Time to Launch | 2–4 months | 12–18+ months | 6–12 months |

| Operational Risk | Low (proven workflows) | High | Medium–High |

| Scalability | Built for multi-region growth | Requires re-engineering | Often limited |

| Long-Term ROI | Faster breakeven | Slow, capital-intensive | Depends on adoption |

For oil companies, speed and reliability matter more than owning every line of code. White-label platforms allow teams to test markets, secure enterprise contracts, and scale confidently, without tying growth to long technology cycles.

That’s why, in practice, most successful fuel delivery launches I’ve seen start white-label first and evolve from there.

Business Models & ROI for Oil Companies

From what I've seen over the last 10 years, the mobile fuel delivery business works best when oil companies stop thinking like retailers and start thinking like enterprise service providers. The revenue logic is very different and far more predictable.

1. Enterprise Contracts & Fleet Subscriptions

The strongest business model is built around long-term B2B agreements rather than per-transaction sales.

- Monthly or annual contracts with logistics fleets, construction companies, generators, and industrial sites

- Committed fuel volumes and scheduled deliveries

- Negotiated pricing with predictable demand

This model reduces sales volatility and makes supply planning far more accurate compared to retail walk-ins.

2. Better Cost Economics Than Retail Infrastructure

Fuel stations require land, staffing, utilities, and continuous foot traffic to stay profitable. On-demand delivery shifts costs toward:

- Mobile tankers and optimized routes

- Centralized dispatch instead of multiple locations

- Lower fixed overhead per customer at scale

When routes are optimized and deliveries are consolidated, margins often improve, even without increasing fuel prices.

3. Faster Breakeven With White-Label Platforms

Technology is usually the highest hidden cost. White-label platforms remove that barrier.

- No long development cycles or R&D burn

- Compliance-ready systems from day one

- Revenue generation starts within weeks of onboarding customers

In real deployments I’ve worked on, companies using white-label platforms reached breakeven 6–12 months faster than those building from scratch.

4. Long-Term ROI Through Data & Retention

Fuel delivery platforms capture usage, frequency, and demand patterns.

- Sales teams use data to renegotiate contracts

- Operations teams reduce wastage and idle time

- Customers stay longer due to service integration

This combination of recurring revenue, lower operational risk, and faster launch creates a compelling ROI story, especially for oil companies looking to scale without expanding physical infrastructure.

Future of White-Label Fuel Delivery Platforms

Over the past decade, I’ve watched fuel delivery platforms evolve from simple order-and-dispatch tools into full-scale enterprise systems. What’s coming next is even more interesting, and it’s where white-label platforms really start to shine for oil companies planning long-term growth.

AI-Based Dispatching Becomes the Norm

Dispatch is no longer just about assigning the nearest truck. Modern platforms are beginning to use AI to:

- Predict demand based on historical consumption and seasonal patterns

- Optimize routes dynamically using traffic, vehicle capacity, and delivery priorities

- Reduce idle time and fuel losses across large fleets

In practical terms, this means fewer missed deliveries and better utilization of assets. something I’ve seen directly impact margins at scale.

IoT-enabled fuel monitoring

IoT-enabled fuel monitoring is another major shift. Sensors installed on storage tanks, vehicles, and mobile dispensers provide continuous visibility into fuel levels and movement. This enables automated refill triggers, early leak detection, and more accurate compliance reporting. For enterprise customers, it eliminates manual logs. For oil companies, it creates a high-value, data-driven service that strengthens long-term contracts.

Beyond Fossil Fuels: EV & Alternative Energy Integration

White-label platforms are also future-proofing fuel delivery by expanding beyond diesel and petrol.

- EV charging management for fleet depots

- LNG, CNG, and biofuel delivery workflows

- Unified billing and reporting across energy types

I’m seeing oil companies use this transition not as a threat, but as an opportunity, to become integrated energy service providers rather than just fuel suppliers.

The takeaway is simple: white-label fuel delivery platforms aren’t just a faster way to launch today. They’re the foundation for scaling into tomorrow’s energy ecosystem, without constantly rebuilding technology from scratch.

Conclusion: Launch Faster Without Building Tech In-House

Fuel delivery has become a core growth channel for oil companies, not a side project. The real advantage comes from launching quickly while staying compliant and in control. That’s exactly where white-label solutions fit.

A white-label fuel delivery platform enables oil companies to enter on-demand fuel delivery without long development cycles or technical risk. It delivers speed, regulatory readiness, and full control over branding, data, and customer relationships, all without building and maintaining complex systems internally.

For enterprise and fleet-focused operations, choosing an enterprise-ready platform means faster go-to-market, lower risk, and a clear path to scale. It’s a practical, future-proof way to grow fuel delivery services while keeping the focus on operations, customers, and long-term value.

Continue Your Journey

Want to see how doorstep fuel delivery works in a real-world, operational setup? Explore this detailed case study that breaks down platform design, compliance, and execution.

Doorstep Fuel Delivery Case Study

Frequently Asked Questions:

1. What is a white-label fuel delivery platform?

A white-label fuel delivery platform is a ready-made fuel delivery software that oil companies can launch under their own brand. It includes dispatch, compliance workflows, billing, and reporting, while giving full control over data and customer relationships, without building the technology from scratch.

2. Can oil companies launch fuel delivery without building technology?

Yes. Many oil companies use white-label or enterprise fuel delivery software to go live quickly. This approach avoids long development timelines and allows teams to focus on operations, compliance, and customer acquisition instead of software maintenance.

3. Is on-demand fuel delivery legal in India?

On-demand fuel delivery is legal in India when operated under government guidelines. Companies must obtain PESO approvals, use certified mobile fuel dispensers, and follow safety and documentation requirements set by oil marketing companies and regulators.

4. How much does enterprise fuel delivery software cost?

Costs vary based on scale, features, and integrations. Most enterprise platforms follow a SaaS or licensing model, which is significantly more cost-effective than building a custom system from scratch and typically allows faster breakeven.

5. Should oil companies build or buy fuel delivery technology?

For most oil companies, buying a white-label platform is the smarter choice. It reduces risk, speeds up market entry, and ensures compliance readiness, while still allowing customization and long-term scalability.